Binghatti Circle Development Investment Full Details

Table of Contents

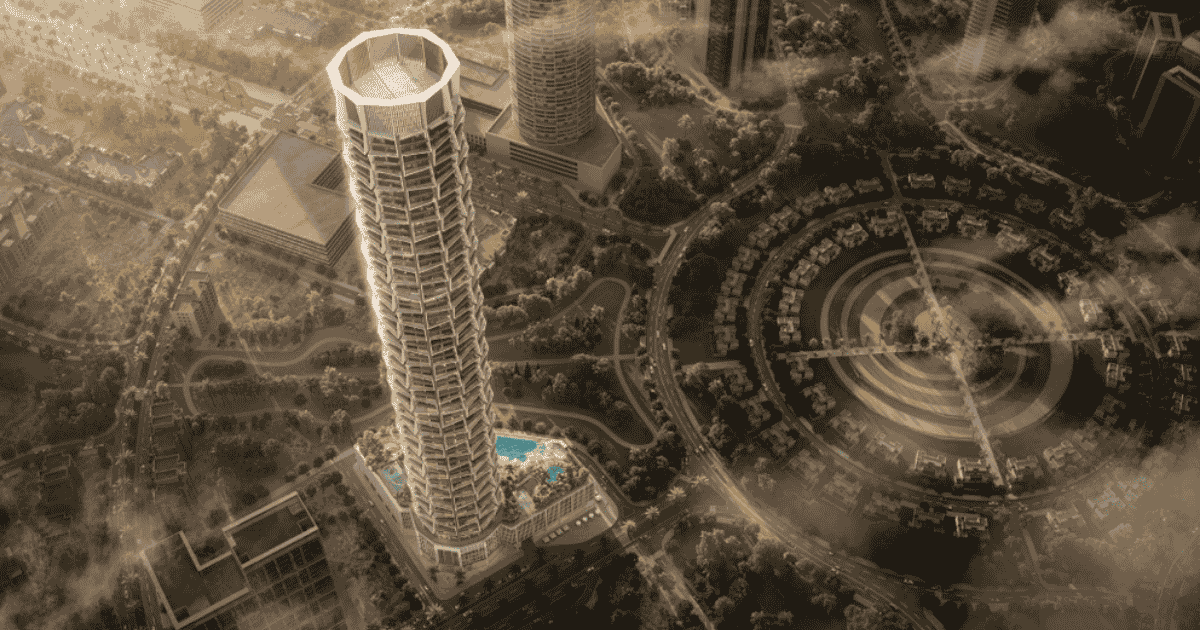

The Tallest Residential Tower in JVC – A Rare Investment Built for Long-Term ROI

Binghatti Circle is more than a landmark — it’s a data-backed opportunity in the heart of Dubai’s most transacted residential zone: Jumeirah Village Circle (JVC). Developed by Binghatti, one of the UAE’s most powerful Emirati developers (with over AED 50 billion in active projects), this tower rises 58 floors high — making it the tallest residential building in JVC.

With a limited number of 776 freehold residential units, including high-demand studios and 1-bedroom apartments — investors are securing long-term capital growth, consistent rental income, and strategic exit potential in Dubai’s most in-demand community.

Developer Profile: Binghatti – Powerhouse of Branded Real Estate

- Portfolio Value: AED 50+ Billion

- Completed Units: 20,000+ delivered across UAE

- Collaborations: Bugatti Residences, Mercedes-Benz Places, Jacob & Co. Tower

- Specialization: Branded, ultra-iconic towers in top freehold zones

- Reputation: High delivery rate, iconic facades, and engineering precision

Location: Prime Plot in Jumeirah Village Circle (JVC), Dubai

- Connectivity:

- 2 min from Circle Mall

- 8 min from Al Khail Road

- 12 min from Dubai Marina / Mall of the Emirates

- 20 min from Downtown Dubai / DIFC

- Community Strengths:

- High rental demand from professionals & couples

- Strong infrastructure with schools, clinics, parks

- High-transacting zone (among Dubai’s top 5 for sales & rentals)

Binghatti Circle Project Specifications

| Item | Details |

|---|---|

| Developer | Binghatti |

| Plot Size | 6,421.58 sqm / 69,121.24 sqft |

| Structure | 2B + G + 4P + 58 Floors + 3 Mech + Roof |

| Total Units | 776 Residential, 31 Offices, 15 Retail Shops |

| Handover | Q4 2026 (Planned) |

| Ownership | 100% Freehold |

| Unit Types | Studio, 1BR, 2BR, 3BR |

| License | Residential + Holiday Home Approved |

| Eligibility | 10-Year Golden Visa for units ≥ AED 2M |

Unit Prices, Sizes & Price per Sqft – Binghatti Circle Real Inventory

All numbers are direct from the developer

| Unit Type | Code | Total Area (sqft) | Net Area (sqft) | Price (AED) | Price/Sqft |

|---|---|---|---|---|---|

| Studio | BCRL-1119 | 384.05 | 307.74 | 680,999 | 1,773 AED |

| Studio | BCRL-1120 | 384.37 | 307.74 | 681,999 | 1,774 AED |

| Studio | BCRL-1318 | 384.16 | 307.74 | 682,999 | 1,777 AED |

| 1 Bedroom | BCRL-1210 | 599.98 | 468.23 | 995,999 | 1,660 AED |

| 1 Bedroom | BCRL-1211 | 603.56 | 471.45 | 998,999 | 1,655 AED |

| 1 Bedroom | BCRL-1412 | 610.35 | 475.88 | 1,010,000 | 1,655 AED |

| 2 Bedroom | BCRL-1617 | 956.62 | 750.20 | 1,650,000 | 1,725 AED |

| 2 Bedroom | BCRL-1618 | 1,020.00 | 802.44 | 1,720,000 | 1,686 AED |

| 3 Bedroom | BCRL-1702 | 1,328.92 | 1,024.78 | 2,248,000 | 1,692 AED |

- Terrace sizes range from 60–120 sqft based on unit

- All units have open views: Main Road, Park, Skyline or Cityscape

- Price per sqft is net-to-net, no hidden premium or marketing inflation

ROI Breakdown – Binghatti Circle in JVC

Long-Term Rental Yields (Annual)

| Unit Type | Avg Rent/Year (JVC) | Entry Price (AED) | Gross ROI % | Est. Net ROI % (after 20% costs) |

|---|---|---|---|---|

| Studio | AED 55,000 | AED 680,999 | 8.07% | 6.45% |

| 1BR | AED 75,000 | AED 995,999 | 7.53% | 6.02% |

| 2BR | AED 100,000 | AED 1,650,000 | 6.06% | 4.85% |

| 3BR | AED 120,000 | AED 2,248,000 | 5.33% | 4.20% |

Operating costs assumed: 5% service charge + 5% property management + 10% vacancy/turnover

Short-Term Rental ROI (Holiday Home Strategy)

| Unit Type | Avg Nightly Rate | Occupancy (70%) | Gross Income/Year | Est. ROI (%) |

|---|---|---|---|---|

| Studio | AED 250/night | 256 nights | AED 64,000 | 9.4% |

| 1BR | AED 350/night | 256 nights | AED 89,600 | 9.0% |

| 2BR | AED 500/night | 256 nights | AED 128,000 | 7.7% |

- Binghatti Circle allows short-term licensing

- Atlantis Real Estate provides turnkey property management

- Airbnb, Booking, and travel agencies integrated

Service Charges & Cost to Own

- Service Fee Estimate: AED 14–16/sqft/year

- Studio Service Fee: ~AED 5,300/year

- 1BR Service Fee: ~AED 9,500/year

- 2BR Service Fee: ~AED 13,500/year

No income tax or capital gains tax in Dubai

JVC vs Competing Districts: Price & ROI Snapshot

| Area | Avg Price/Sqft | Avg ROI (1BR) | Entry Price (1BR) | Investor Notes |

|---|---|---|---|---|

| JVC | AED 1,400–1,700 | 7.5–9.0% | From AED 900K | High volume, low entry, high rental turnover |

| Dubai Hills | AED 2,100–2,400 | 5.2–6.0% | From AED 1.4M | Premium zone, lower yield |

| Downtown Dubai | AED 2,600–3,100 | 4.0–5.5% | From AED 2.2M | Capital preservation, low ROI |

| Arjan | AED 1,000–1,300 | 7.2–8.5% | From AED 750K | Budget market, but weaker exit appeal |

JVC is outperforming in ROI vs Downtown, Dubai Hills, and even Arjan

Binghatti Circle is the most iconic tower in JVC, giving it premium resale positioning

Resale Strategy: 3-Year Outlook

| Year | Projected Price/Sqft | Expected Appreciation | Studio Value | 1BR Value |

|---|---|---|---|---|

| 2025 | AED 1,700 | — | AED 680K | AED 995K |

| 2026 | AED 1,850 | +8.8% | AED 739K | AED 1.08M |

| 2027 | AED 2,020 | +9.2% | AED 775K | AED 1.17M |

Estimated resale gain: AED 80K–175K depending on unit & exit year

Premium resale value due to tower height + smart home features + landmark design

Ideal Buyer Profiles & Strategy for Binghatti Circle

1. Income-Driven Investor

- Buys studio or 1BR under AED 1M

- Goal: Net ROI 6–9% annually through long-term or holiday rentals

- Strategy: Hold for 3–5 years, generate cash flow

- Reinvest returns into off-plan portfolio via Abu Nahyan’s pipeline

2. Golden Visa Buyer

- Buys 2BR+ unit (AED 2M+)

- Eligible for 10-year UAE Golden Visa

- Goal: Dual benefit – lifestyle + long-term capital gains

- Strategy: Use it as a second home or holiday base while value grows

3. Flipper / Short-Term Exit Buyer

- Buys premium view units (corner 1BRs, 2BR skyline units)

- Strategy: Sell pre-handover or 6 months post-handover at 10–15% markup

- Advantage: High demand for top-floor units, limited inventory = price pressure

Investor Psychology

| What? | Binghatti Circle |

|---|---|

| Scarcity | Only a handful of 2BR & 3BR units available – resale leverage later |

| Prestige Anchor | Tallest in JVC + Binghatti brand = long-term resale dominance |

| Low Entry Point | Studios & 1BRs under AED 1M with 7–9% ROI – impossible in Marina/Downtown |

| Emotion-Logic Balance | High-spec design + smart home + central location = confidence to buy |

“You’re not just buying a unit — you’re securing the tallest asset in the fastest-growing district, with yields beating most of Dubai. You win on entry, income, and exit.”

Ready to Secure Your Unit at Binghatti Circle?

Whether you’re an investor looking for guaranteed passive income, an end-user securing Golden Visa privileges, or a strategic flipper ready to exit at 15% profit, this is your moment.

Binghatti Circle Development Investment Full Details in Dubai shows one thing clearly:

You’re getting location, architecture, yield, and long-term capital growth in one package — with no Dubai-level taxes or market noise.

Contact the Expert Behind the Deals

Abu Nahyan Al Nuaimi

Co-Founder & Senior Investment Advisor

🏆 CEO, Atlantis Real Estate (Best Luxury Independent Brokerage 2025)

VIP onboarding, site visits, and guaranteed investment matching are available.

FAQ – Binghatti Circle Development Investment Full Details in Dubai

Read more: Binghatti Circle Development Investment Full Details

1- Ellington: Who Are These Guys? Who is The Silent Investor?