Fixed Income Assets The Richest Do not Want you to know

The Secret Playbook of the Rich

Most people believe the rich get richer by taking big risks.

They picture billionaires betting on stocks, chasing crypto, or buying entire companies overnight. However, Fixed Income Assets The richest Do not Want you to know do exist and we will show you!

But that’s only part of the story.

The real secret is less flashy.

The real secret is fixed income assets.

Fixed income is quiet.

It doesn’t grab headlines.

It doesn’t make you rich overnight.

But it does something more powerful.

It builds wealth slowly.

It protects fortunes.

It delivers checks on time—whether the market is up or down.

This is why governments, pension funds, and the wealthiest families rely on it.

It’s boring.

But boring is safe.

And safe is powerful.

Think about a bond.

When you buy one, you’re lending money.

The deal is simple:

- You get interest payments on schedule.

- You get your money back when the bond matures.

No drama.

No guessing.

Just steady cash flow.

That’s why the Fixed Income Assets The richest Do not Want you to know are not talked about loudly.

The rich keep them quiet while everyone else chases hype.

Someone Else Is Already Collecting Your Paycheck

Here’s a fact most people never think about.

Every month, millions of people make mortgage and loan payments.

Where does that interest go?

Not to the teller at the counter.

Not to the local bank manager.

It goes to investors.

Wealthy people holding bonds and fixed income products.

They get paid because you’re paying.

If you’re not collecting fixed income, you’re funding someone else’s.

That’s how the game is played.

The rich know this.

They don’t gamble first.

They build a safety net of guaranteed income.

Once that’s in place, then they take risks.

They can afford to lose on one side, because fixed income is paying on the other.

That’s the psychology of wealth.

Defense before offense.

Protection before speculation.

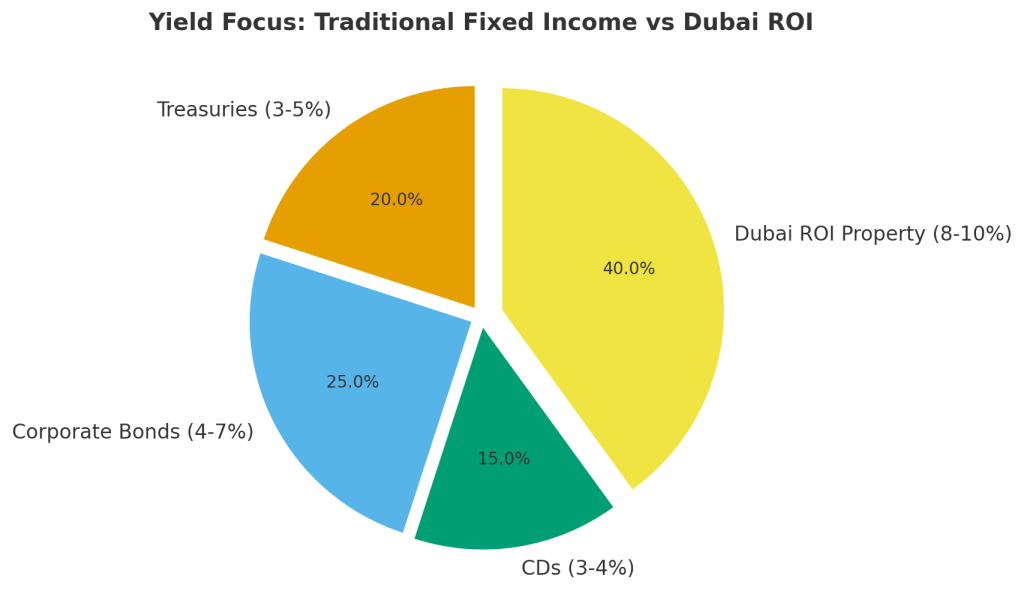

Now here’s the twist.

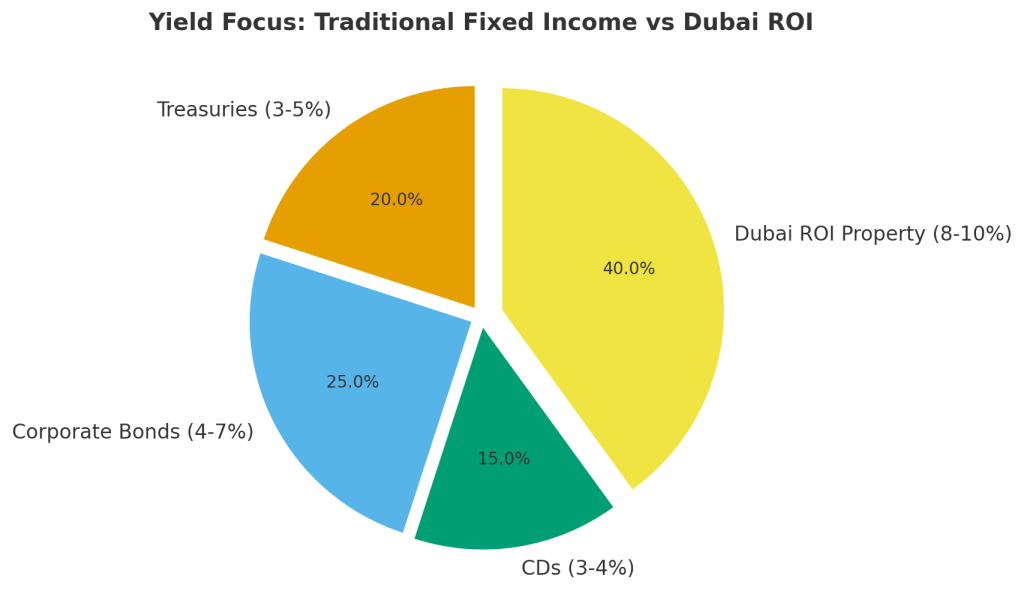

Traditional fixed income—government bonds, corporate bonds, CDs—pays just 3–5%.

Safe, yes.

But small.

The wealthy aren’t satisfied with small.

They want more.

That’s why in 2025, many of them are shifting into something new.

Something that looks like fixed income.

But pays double.

They are choosing real estate projects with guaranteed ROI.

Properties structured like bonds.

Contracts that promise 8–10% returns.

Protected by Dubai Land Department laws.

It’s fixed income—only stronger.

In this article, we’ll go step by step.

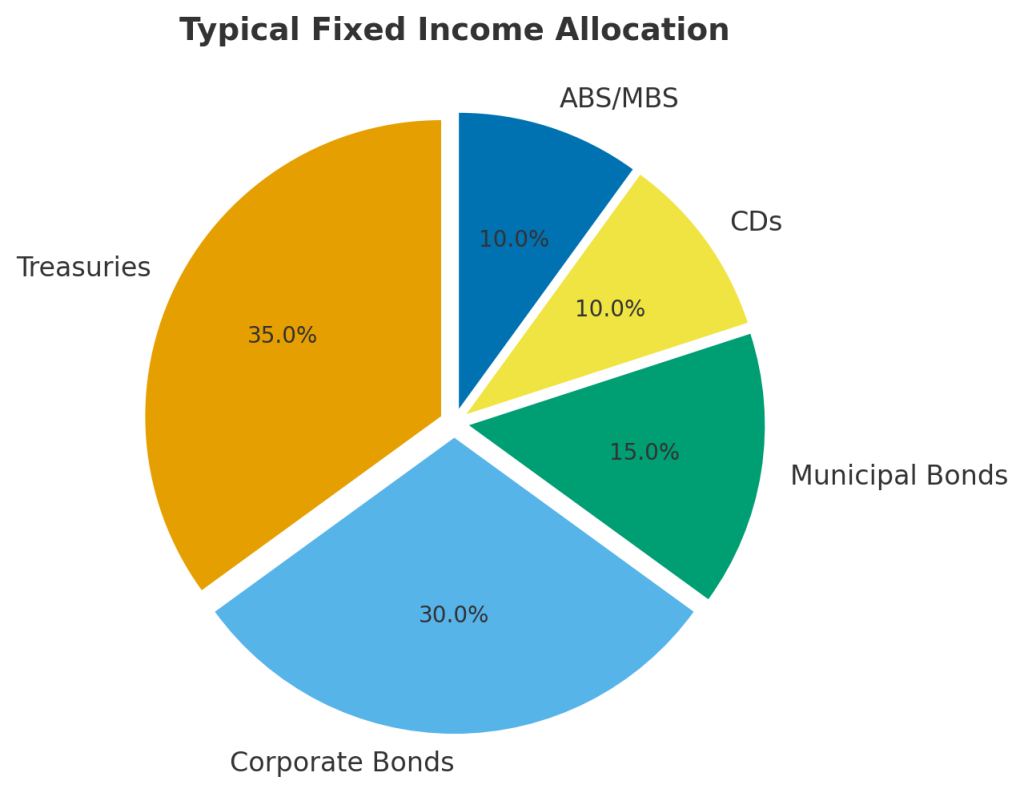

You’ll learn about every traditional fixed income product—Treasury bills, corporate bonds, CDs, and more.

Then, you’ll see why the rich are moving toward real estate with guaranteed ROI.

By the end, you’ll know the truth.

That the Fixed Income Assets The richest Do not Want you to know aren’t only bonds.

They include powerful new investments that deliver stability and wealth at the same time.

Fixed Income Assets The Richest Do not Want you to know

Understanding Fixed Income

Fixed income sounds complicated.

But it’s actually simple.

It means: you invest your money, and you get paid a fixed amount back at regular times.

Think of it as lending money.

The borrower can be a government, a company, or even a bank.

In return, they agree to pay you interest and give back your money at maturity.

This is different from stocks.

With stocks, you buy ownership.

Your return depends on performance.

It could go up big—or crash.

With fixed income, there’s no guesswork.

You don’t own the company.

You’re a lender, not an owner.

That’s why wealthy investors love it.

Key Terms Made Easy

Coupon: The interest payment you get (like a paycheck).

Par value: The amount you invested (usually $1,000 per bond).

Maturity: The date when you get your money back.

Example:

You buy a bond for $1,000 with a 5% coupon.

Every year, you get $50.

At maturity, you get your $1,000 back.

Simple.

Predictable.

Safe.

Why the Rich Love Fixed Income

The rich don’t care about bragging rights.

They care about certainty.

Fixed income lets them sleep at night.

It gives them:

- Stability: Money flows in on schedule.

- Protection: Principal comes back at maturity.

- Balance: Lower risk compared to stocks.

This is why wealthy families and institutions always keep a large slice of their money in fixed income.

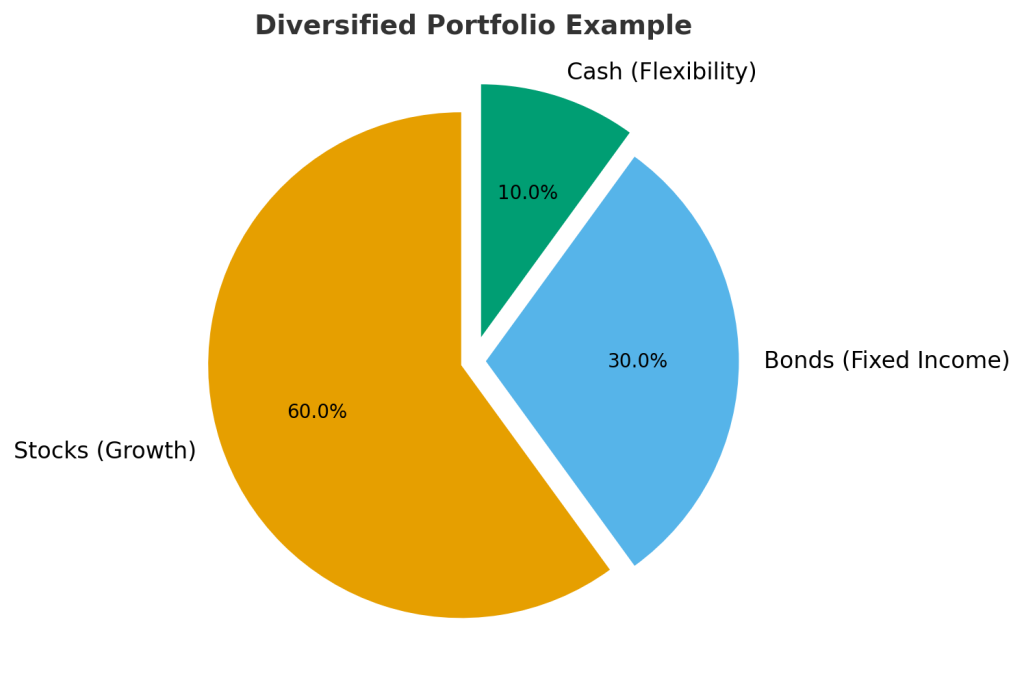

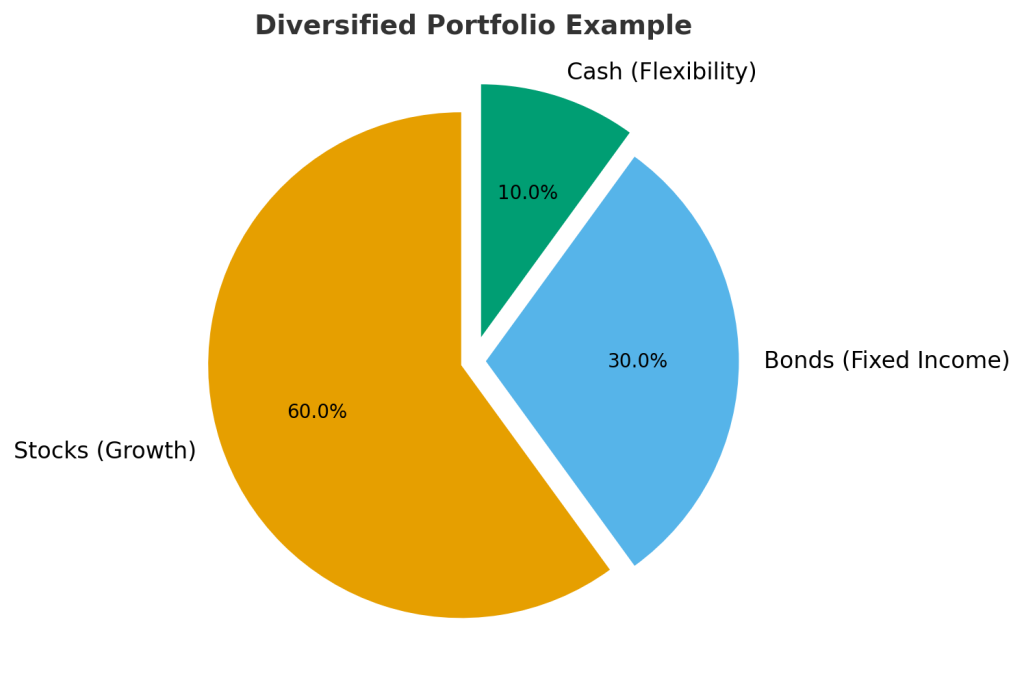

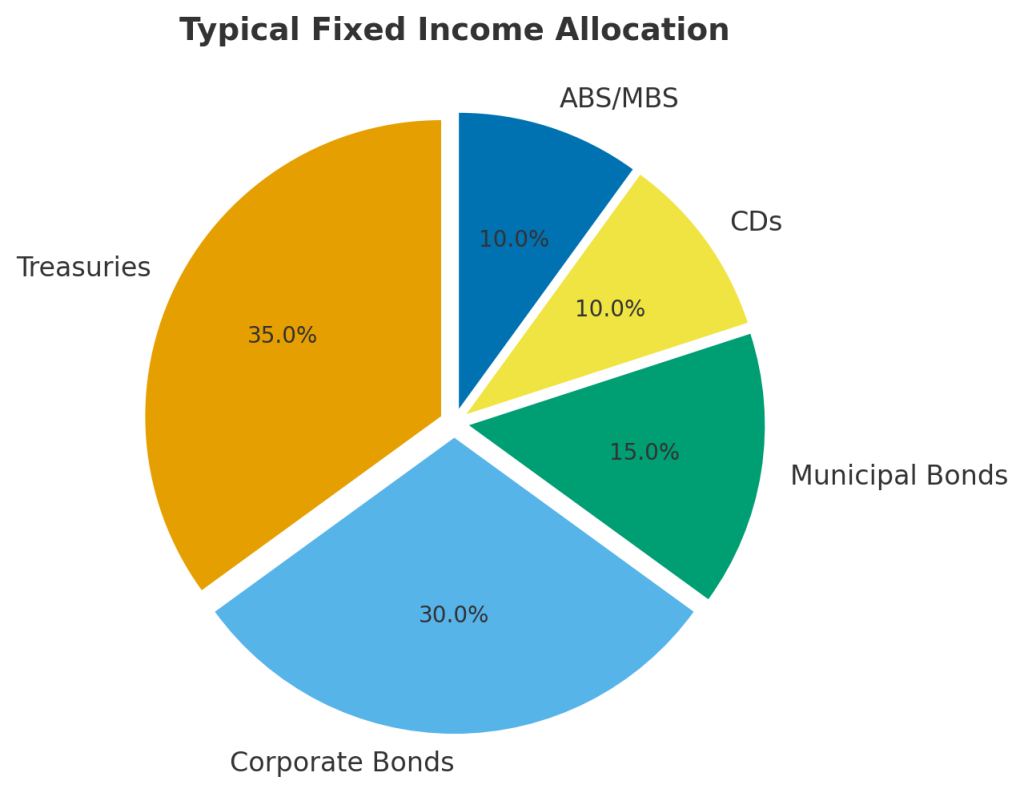

Fixed Income in a Portfolio

Imagine you have $1,000,000.

Would you put it all in stocks? Probably not.

Wealthy investors split it.

Some in stocks for growth.

Some in fixed income for stability.

Typical mix:

- 60% stocks

- 30% (fixed income)

- 10% cash or alternatives

That 30% makes sure they never run dry.

Even in a market crash, the checks keep coming.

Example

The truth is, most people ignore this.

They want excitement.

They want fast gains.

But the rich?

They want predictable cash flow.

They want certainty.

That’s why they keep fixed income at the core of their portfolios.

The Rich Don’t Gamble—They Collect Predictable Checks. Do You?

This is the mindset shift.

Most people think wealth is built by taking huge risks.

But the wealthy know it’s built by guaranteeing income first.

If you’re not collecting fixed income checks every month or every year, you’re already behind.

The rich don’t leave it to chance.

They lock it in.

Treasury Securities

When people say “safe investment,” they usually mean U.S. Treasury securities.

These are fixed income products issued directly by the U.S. government.

Why are they considered safe?

Because they’re backed by the full faith and credit of the government.

That means the U.S. guarantees to pay you back.

For wealthy investors, that’s gold.

Not because of the high returns (they’re actually small).

But because of the certainty.

Treasury Bills (T-Bills)

T-Bills are short-term.

They mature in less than one year.

They don’t pay interest like normal bonds.

Instead, you buy them at a discount.

At maturity, you get the full value.

Example:

You buy a T-Bill for $9,800.

It matures at $10,000.

That $200 difference is your profit.

It’s simple.

It’s safe.

And it’s why governments and wealthy investors use them as cash-like investments.

Treasury Notes (T-Notes)

T-Notes are longer.

They mature in 2 to 10 years.

They pay a fixed interest rate, called a coupon.

Payments come every six months.

Example:

You buy a $10,000 T-Note at 4%.

You receive $400 every year, split into two $200 payments.

At maturity, you get your $10,000 back.

Wealthy investors like T-Notes for predictable mid-term cash flow.

Treasury Bonds (T-Bonds)

T-Bonds are even longer.

They mature in 20 or 30 years.

They also pay fixed interest every six months.

But the big difference is the timeline.

If you buy a 30-year bond, you’re locking in decades of income.

That’s why institutions—like pension funds—buy them in bulk.

Example:

$100,000 in T-Bonds at 4%.

That’s $4,000 in interest every year.

For 30 years.

It’s a slow but steady way to guarantee wealth preservation.

Treasury Inflation-Protected Securities (TIPS)

TIPS are special.

They protect against inflation.

Here’s how:

The principal (the amount you invest) adjusts with inflation.

If inflation rises, the principal rises.

If inflation falls, the principal drops.

Your interest payments are based on that adjusted principal.

Example:

You buy $10,000 in TIPS.

Inflation pushes principal to $10,500.

Your interest is calculated on $10,500, not $10,000.

This way, you don’t lose purchasing power.

Wealthy investors use TIPS as insurance.

Why the Rich Love Treasuries

- They’re liquid. Easy to buy and sell.

- They’re government-backed. Almost no risk of default.

- They provide steady, predictable returns.

The downside?

Returns are small.

A 10-year T-Note might pay 4%.

A 30-year T-Bond might pay 5%.

Safe? Yes.

Exciting? No.

But the wealthy don’t care about excitement.

They care about certainty.

And Treasuries deliver that.

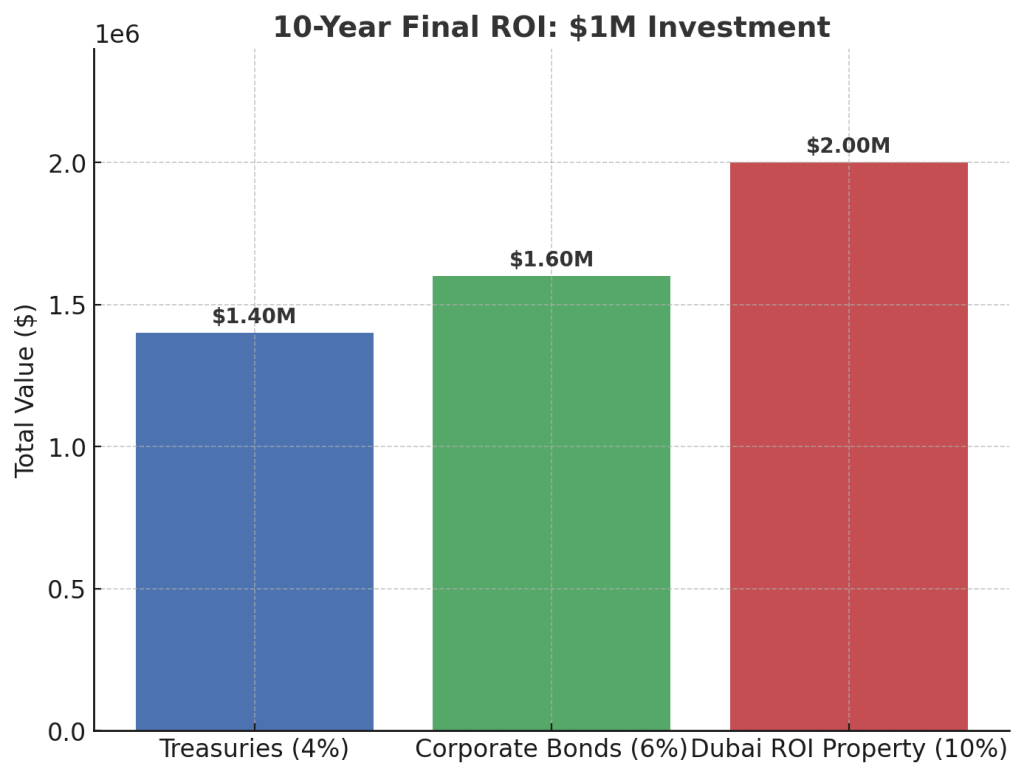

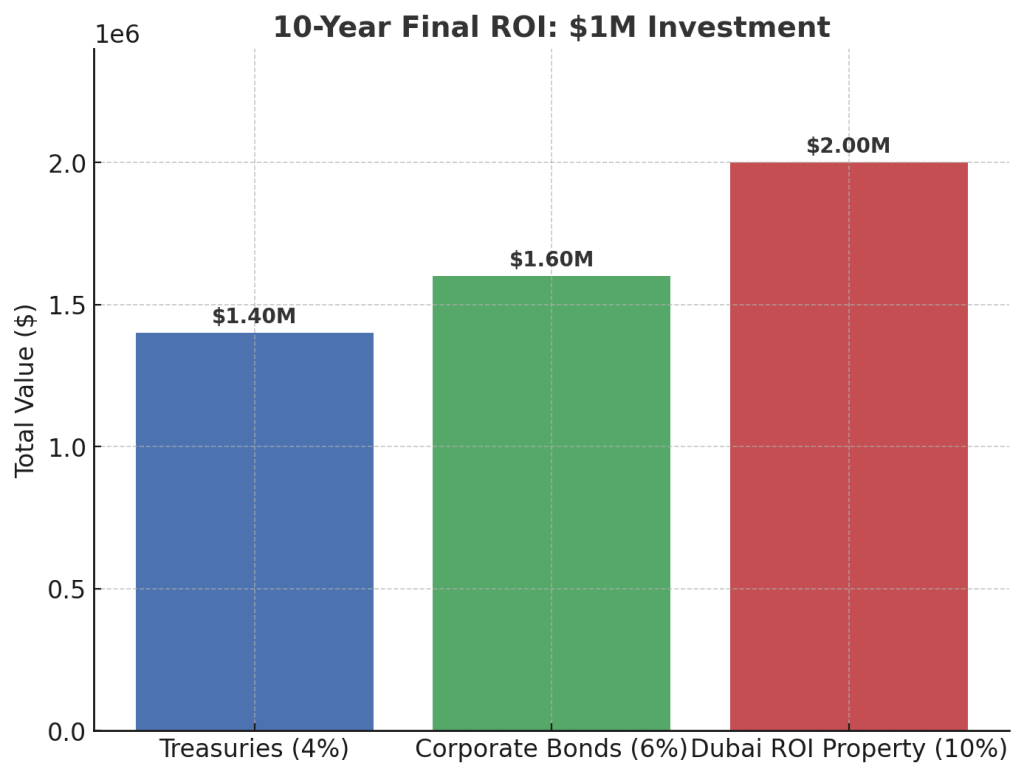

Real Numbers

If you put $1,000,000 into T-Bonds at 4%, you’d earn $40,000 per year.

Safe, predictable.

But compare that to guaranteed ROI real estate in Dubai.

$1,000,000 at 10% earns $100,000 per year.

More than double the income.

That’s why the rich still buy Treasuries…

But they also look for alternatives that pay more while still staying safe.

Fixed Income Assets The Richest Do not Want you to know

Visual Table: Treasuries Overview

| Security | Maturity | Pays Interest? | Risk | Typical Yield | Best For |

|---|---|---|---|---|---|

| T-Bills | < 1 year | No (discount) | Very Low | 3–4% | Short-term safety |

| T-Notes | 2–10 years | Yes (semi-annual) | Very Low | 4–5% | Mid-term cash flow |

| T-Bonds | 20–30 years | Yes (semi-annual) | Very Low | 4–5% | Long-term stability |

| TIPS | 5–30 years | Yes (inflation-adjusted) | Very Low | 3–4% + inflation | Protecting purchasing power |

The Government Prints Safety. The Rich Buy It First.

Treasuries aren’t glamorous.

They won’t make you rich overnight.

But the wealthy don’t care.

They buy safety.

They buy certainty.

And while everyone else is distracted by market drama, the rich are quietly collecting government-backed checks.

Municipal Bonds

Municipal bonds are often called “munis.”

They are issued by states, cities, or local governments.

Why?

To raise money for public projects.

Think schools, highways, hospitals, or water systems.

When you buy a muni bond, you’re lending money to your city or state.

In return, they pay you interest—usually every six months.

The Tax Advantage

Here’s why wealthy investors love municipal bonds.

The interest is often tax-free.

That means if you earn $10,000 in interest from munis, you don’t pay federal tax on it.

Sometimes you don’t even pay state or local taxes, depending on where you live.

For rich investors in high tax brackets, this is huge.

It makes a 4% muni bond worth more than a 6% taxable bond.

Real Example

Say you invest $500,000 into municipal bonds at 4%.

That’s $20,000 per year in income.

Now compare it to a corporate bond paying 6%.

On paper, the corporate bond looks better.

But if you’re in a 35% tax bracket, you only keep $3,900 out of every $6,000 earned.

That’s $19,500 net.

The muni bond actually gives you more.

And it’s safer.

Who Buys Munis?

- Wealthy individuals looking to reduce taxes.

- Retirees who want steady, safe income.

- Large funds that need tax-advantaged income.

This is why municipal bonds remain popular.

They might not pay the highest yields, but the tax savings make them powerful.

The Downside

Munis are not risk-free.

If a city or state struggles financially, it can default.

It’s rare, but it happens.

Think of Detroit’s bankruptcy.

Bondholders lost money.

So while munis are safer than corporate bonds, they still carry local government risk.

Visual Snapshot

| Bond Type | Who Issues It | Typical Yield | Tax Benefits | Risk Level |

|---|---|---|---|---|

| Municipal | City/State | 3–5% | Often tax-free | Low to Medium |

Why the Rich Like Them

The rich don’t just want income.

They want after-tax income.

And that’s where munis shine.

If you can earn money without paying extra taxes, you’re already ahead.

That’s why municipal bonds are a favorite tool for high-net-worth families.

Transition to Bigger Picture

But here’s the catch.

Even with tax savings, munis rarely pay more than 5%.

For the ultra-wealthy, that’s not enough.

So while they still buy munis, they also look for higher-yield alternatives that give them the same safety but more return.

Fixed Income Assets The Richest Do not Want you to know

What Feels “Small” to You Feeds the Wealth of the Rich

Municipal bonds may look boring.

But to the rich, every tax-free dollar matters.

What feels like small returns to the average person quietly grows into millions for wealthy investors.

That’s the difference in mindset.

Corporate Bonds

When companies need money, they don’t always issue stocks.

Sometimes, they borrow by selling corporate bonds.

A corporate bond is simple.

You lend money to a company.

The company promises to pay you interest, usually twice a year, and return your money at maturity.

Why Companies Issue Bonds

- To fund new projects.

- To expand operations.

- To refinance old debt.

Instead of taking a bank loan, companies raise billions directly from investors.

Wealthy investors are often the first in line.

Credit Ratings Matter

Not all companies are equal.

Some are strong, safe, and reliable.

Others are risky.

That’s why bonds are rated.

- AAA: The safest. Companies like Microsoft or Apple might have this rating.

- BBB: Medium risk. Stable but not bulletproof.

- CCC: Very risky. Might default.

The higher the risk, the higher the interest rate.

But wealthy investors often prefer safety over chasing huge yields.

Investment-Grade vs Junk Bonds

- Investment-Grade Bonds (AAA to BBB): Safe, steady, lower yields (3–6%).

- High-Yield or “Junk” Bonds (BB and below): Risky, higher yields (7–12%+).

Example:

Coca-Cola might issue a bond at 4%.

Safe, predictable.

A struggling airline might issue a bond at 9%.

High risk, but tempting returns.

The rich usually buy investment-grade.

They don’t gamble with their core wealth.

Real Example

Let’s say you invest $1,000,000 in a corporate bond at 5%.

That’s $50,000 per year in steady income.

But if you chase a junk bond at 10%, you’d earn $100,000.

Sounds good—until the company defaults and you lose big.

This is why the wealthy are selective.

They’d rather earn a bit less, but keep their money safe.

Who Buys Corporate Bonds?

- Pension funds

- Insurance companies

- Banks

- High-net-worth individuals

Institutions love corporate bonds because they need reliable cash flow to cover long-term obligations.

Wealthy individuals like them because they combine safety with slightly better returns than government bonds.

The Risks

Corporate bonds are not risk-free.

- If the company defaults, you may lose money.

- If interest rates rise, bond prices fall.

- If inflation spikes, your returns shrink in real terms.

That’s why investors check credit ratings before buying.

Corporate Bonds vs Treasuries

| Feature | Corporate Bonds | Treasury Bonds |

|---|---|---|

| Issuer | Companies | U.S. Government |

| Risk | Medium–High | Very Low |

| Yield | 4–8% (IG), up to 12% (junk) | 3–5% |

| Tax | Taxable | Taxable |

| Safety | Depends on company health | Guaranteed by U.S. |

Corporate bonds pay more.

But Treasuries are safer.

That’s why rich investors often hold both.

Why the Rich Buy Them

Corporate bonds are powerful for one reason:

They pay more than Treasuries.

And when you buy from strong companies, the risk is manageable.

It’s a middle ground.

More income than government bonds.

Less risk than stocks.

The wealthy use them as a steady layer in their portfolios.

Transition to Bigger Picture

But even here, returns are usually capped around 6–7% for strong companies.

For billionaires, that’s not always enough.

That’s why many now use real estate guaranteed ROI projects—structured like corporate bonds but delivering 8–10% with full legal protection.

Fixed Income Assets The Richest Do not Want you to know

Stocks Make Headlines. Corporate Bonds Make Fortunes Quietly.

Stocks get the spotlight.

Everyone talks about them.

But corporate bonds quietly feed the fortunes of the wealthy.

Steady interest payments.

Steady returns.

Steady growth.

It’s not glamorous.

But it’s how the rich stay rich.

Certificates of Deposit (CDs)

Not every fixed income asset comes from governments or corporations.

Some come from regular banks.

A Certificate of Deposit (CD) is one of the simplest.

You put money into a bank for a set time.

In return, the bank pays you a fixed interest rate.

How CDs Work

- You deposit your money (say $10,000).

- The bank locks it for a fixed term (6 months, 1 year, 5 years).

- You earn interest during that time.

- At the end, you get back your deposit plus interest.

CDs are very safe.

They’re insured by the FDIC in the U.S. (up to $250,000).

This means even if the bank fails, your money is still protected.

Example

Imagine you put $100,000 into a 2-year CD at 4%.

Each year, you earn $4,000 in interest.

After 2 years, you get back $108,000 in total.

Safe.

Predictable.

No surprises.

Why Wealthy Investors Use CDs

For the ultra-rich, CDs are not about high returns.

They’re about parking cash safely.

Sometimes wealthy investors sell a business or a property and don’t want to risk the money right away.

So they put millions into CDs to earn interest while they wait for the next big move.

It’s like a storage account that pays you.

The Downside

CDs usually pay less than bonds.

They also lock your money.

If you withdraw early, you face penalties.

So while safe, they’re not flexible.

That’s why most rich investors only use CDs for short periods or as a cash-holding tool.

Visual Snapshot

| Feature | Certificate of Deposit | Bonds |

|---|---|---|

| Issuer | Banks | Governments or Companies |

| Safety | Very High (FDIC insured) | Varies |

| Yield | 3–5% | 3–10% |

| Liquidity | Locked until maturity | Can sell (may lose value) |

Transition to Bigger Picture

CDs are safe, yes.

But they rarely pay more than 4–5%.

For the wealthy, that’s barely enough to cover inflation.

That’s why CDs are used as a temporary stop, not a long-term wealth builder.

Banks Pay You Pennies While the Rich Use Them as Parking Spots for Millions

The average saver sees CDs as a big deal.

But for the rich, CDs are just parking spots.

They don’t get rich off CDs.

They use them to keep money safe—until they move it into higher-return assets.

Asset-Backed Securities (ABS & MBS)

Not all fixed income comes from governments, companies, or banks.

Some come from pools of everyday loans.

These are called asset-backed securities (ABS) and mortgage-backed securities (MBS).

They take things people pay for every month—like car loans, credit card bills, and mortgages—bundle them together, and sell them as investments.

How They Work

- A bank issues loans (car, mortgage, credit card).

- Those loans are packaged into a pool.

- Investors buy pieces of that pool.

- When people make payments, investors get a share.

It’s like collecting interest from hundreds or thousands of borrowers at once.

Mortgage-Backed Securities (MBS)

Mortgages are the most common.

When people pay their home loans, investors receive part of the payment.

Example:

You buy $100,000 in MBS.

Every month, you receive a portion of mortgage payments from thousands of households.

It’s diversified.

Even if one person misses, hundreds of others are still paying.

Asset-Backed Securities (ABS)

ABS are similar but not tied to homes.

They can be built from:

- Auto loans

- Student loans

- Credit card debt

Example:

You buy into an ABS backed by auto loans.

As people make car payments, you collect interest.

It’s steady cash flow—but riskier than government bonds.

The Risks

ABS and MBS are not risk-free.

If too many borrowers stop paying, investors lose money.

This happened in 2008.

When mortgages collapsed, MBS values dropped.

Many investors lost billions.

That’s why today, investors are more cautious.

Who Buys Them

- Hedge funds

- Pension funds

- Large banks

- Wealthy investors with appetite for risk

Why?

Because they often pay more than Treasuries or corporate bonds.

Returns can be 6–9%, sometimes higher.

Visual Snapshot

| Security | Backed By | Yield | Risk Level |

|---|---|---|---|

| MBS | Mortgages | 4–7% | Medium |

| ABS | Auto/Student/Credit Loans | 5–9% | Medium–High |

Why the Rich Use Them

For the rich, ABS and MBS are income multipliers.

They pay better than Treasuries.

And they spread risk across thousands of borrowers.

It’s not as safe as government bonds.

But it’s another layer of steady cash flow.

Transition to Bigger Picture

Still, ABS and MBS come with risk.

They can fail if borrowers stop paying.

That’s why the wealthy don’t put all their money here.

They combine these with safer assets—or replace them with modern alternatives like guaranteed ROI properties.

When You Pay Your Car Loan, Someone Wealthy Is Collecting the Interest

Every time you make a car payment, credit card payment, or mortgage payment, someone is on the other side.

And most of the time—it’s a wealthy investor.

They don’t just buy assets.

They buy your payments.

That’s the power of fixed income.

How to Invest in Fixed Income

Knowing about fixed income is one thing.

But how do you actually invest in it?

The good news: there are many ways.

From buying directly to using funds.

Each has pros and cons.

Direct Purchase

This is the simplest way.

You buy a bond or a CD directly.

Example:

- Buy a $10,000 Treasury bond from the government.

- Hold it for 10 years.

- Collect interest every 6 months.

- Get your $10,000 back at maturity.

It’s safe.

It’s predictable.

But it requires bigger chunks of money.

Mutual Funds

Not everyone wants to buy individual bonds.

That’s where bond mutual funds come in.

A bond mutual fund collects money from many investors.

It then buys hundreds of bonds.

You own a slice of the whole basket.

This gives instant diversification.

And professional managers handle the work.

The downside?

The value of the fund can rise or fall daily.

It’s safer than stocks, but still not risk-free.

Exchange-Traded Funds (ETFs)

Bond ETFs work like mutual funds—but trade like stocks.

You can buy and sell them anytime during the day.

Example:

- You buy a U.S. Treasury ETF.

- Every month, it pays dividends from the bonds it holds.

- You can sell anytime if you need cash.

ETFs are popular because they’re cheap, easy, and flexible.

Laddering Strategy

Wealthy investors often use something called a ladder.

Here’s how it works:

- Put $20,000 in a 1-year bond.

- Put $20,000 in a 2-year bond.

- Put $20,000 in a 3-year bond.

- Repeat for longer maturities.

Every year, one bond matures.

You reinvest into a new one.

This way, you always have money coming back, while still locking in long-term interest rates.

Real Example of Laddering

Imagine $100,000 split like this:

- $20,000 in a 1-year bond (3%).

- $20,000 in a 2-year bond (3.5%).

- $20,000 in a 3-year bond (4%).

- $20,000 in a 4-year bond (4.5%).

- $20,000 in a 5-year bond (5%).

Every year, you get cash back and reinvest.

This spreads risk and keeps income steady.

It’s one of the smartest ways to manage fixed income.

Case Study: $1 Million Portfolio

Investor A puts $1 million into a corporate bond paying 5%.

They earn $50,000 per year.

Investor B splits $1 million into a ladder of Treasuries.

They earn between 3–5% yearly.

Investor C puts $1 million into guaranteed ROI property in Dubai at 10%.

They earn $100,000 per year—double the bond income.

This shows why wealthy investors explore both fixed income and alternatives.

Why the Rich Use Many Methods

- Direct purchase = safety.

- Mutual funds = diversification.

- ETFs = flexibility.

- Ladders = stability.

The rich don’t choose one.

They combine them.

This way, they cover every angle—income, safety, and growth.

Transition to Risks

But even with these strategies, fixed income is not risk-free.

There are dangers every investor must know.

From interest rates to inflation.

And the rich?

They manage these risks carefully—before they commit millions.

Imagine Rent Checks Arriving Monthly—With No Tenants Calling. That’s Fixed Income

Fixed income works like passive rent.

You get paid on schedule.

But without the stress of managing tenants or property.

That’s why the wealthy love it.

It’s money on autopilot.

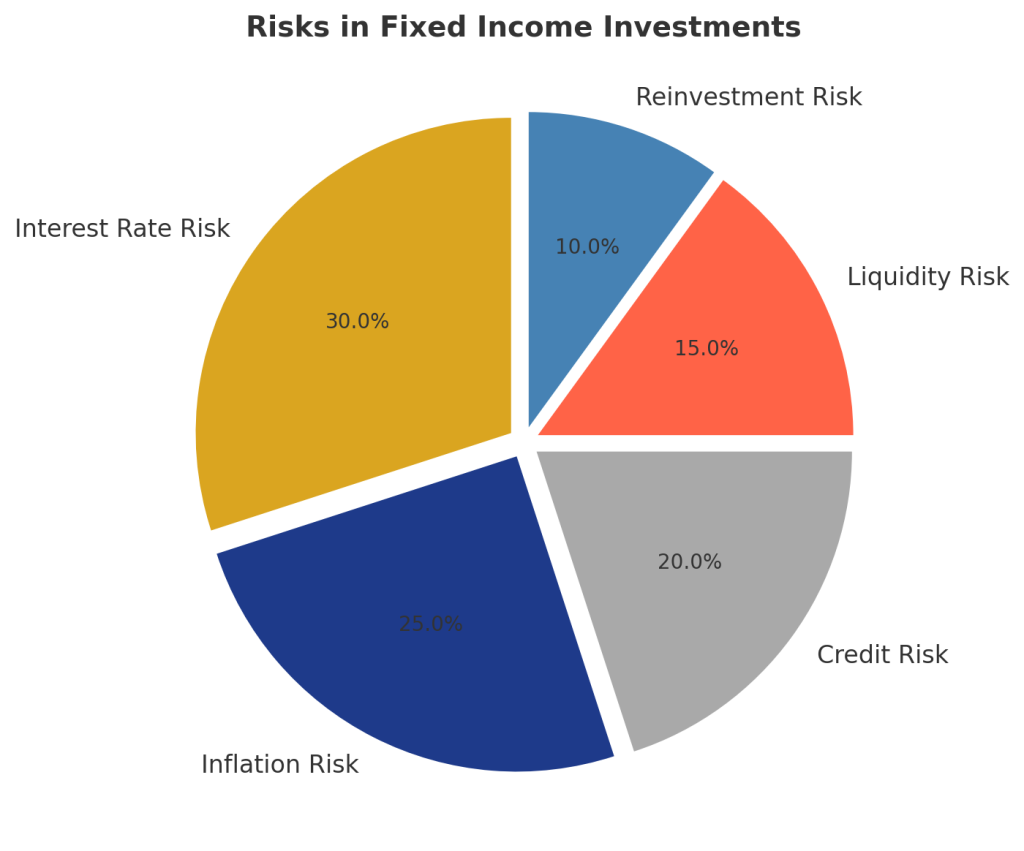

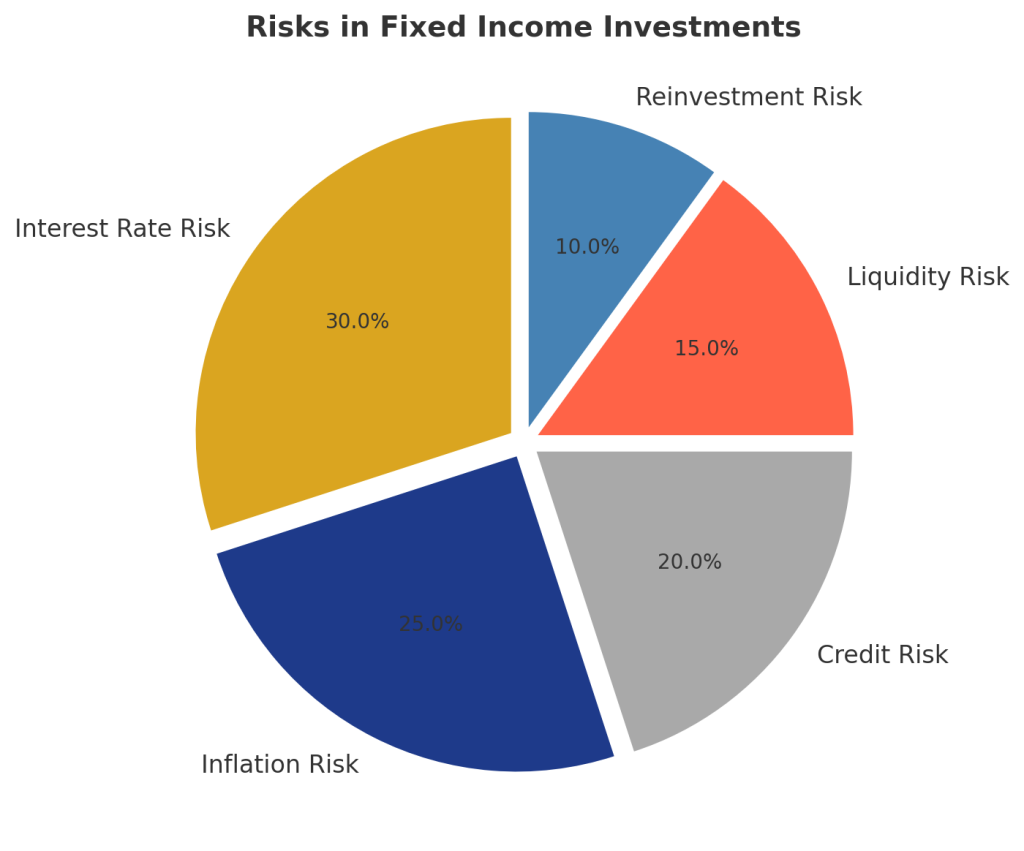

The Risks in Fixed Income

Fixed income sounds safe.

And yes—it’s safer than stocks.

But that doesn’t mean it’s risk-free.

Every fixed income product has weaknesses.

The rich know this.

That’s why they manage risk before investing millions.

Let’s look at the main dangers.

Interest Rate Risk

Interest rates and bond prices move in opposite directions.

When interest rates go up, bond prices go down.

Why? Because new bonds pay more, so old bonds look less attractive.

Example:

- You buy a bond at 4%.

- One year later, new bonds pay 6%.

- No one wants your 4% bond unless you sell it at a discount.

If you hold until maturity, you still get paid.

But if you need to sell early, you may lose money.

The rich avoid this risk by laddering or holding bonds until maturity.

Inflation Risk

Inflation eats your money’s value.

If your bond pays 5% interest, but inflation is 7%, you’re actually losing 2% in real terms.

Your income buys less every year.

That’s why some investors buy TIPS (Treasury Inflation-Protected Securities).

They adjust with inflation.

But even TIPS don’t solve everything.

For the rich, inflation is one reason they now seek alternatives like real estate with guaranteed ROI.

Credit Risk (Default Risk)

This is the chance that the issuer can’t pay.

Example:

- A company issues bonds at 8%.

- But then it struggles financially.

- It defaults, and you may lose everything.

Credit risk is higher in corporate and junk bonds.

The rich protect themselves by sticking with strong, rated companies—or diversifying across many bonds.

Liquidity Risk

Some bonds are hard to sell.

Treasuries are easy.

Corporate or municipal bonds may not be.

If you need cash fast, you might have to sell at a loss.

Wealthy investors reduce this risk by balancing liquid assets (like Treasuries) with less liquid ones.

Reinvestment Risk

This happens when a bond matures during a low-interest-rate period.

Example:

- Your 5% bond matures.

- But new bonds now pay only 3%.

- You have to reinvest at a lower rate.

This is why wealthy investors often lock in longer maturities when rates are high.

Visual Snapshot: Fixed Income Risks

| Risk Type | What It Means | Example | Who It Affects Most |

|---|---|---|---|

| Interest Rate Risk | Bond prices fall when rates rise | 4% bond vs 6% new bond | All investors |

| Inflation Risk | Returns lose value | 5% bond, 7% inflation | Long-term investors |

| Credit Risk | Issuer can’t pay | Junk bond default | Corporate bond buyers |

| Liquidity Risk | Hard to sell | Small city muni bond | Large investors |

| Reinvestment Risk | New bonds pay less | 5% bond matures in low-rate era | Laddering investors |

Why the Rich Still Buy Fixed Income

Even with risks, the rich keep buying fixed income.

Why? Because risk can be managed.

They diversify across:

- Treasuries (safe).

- Munis (tax benefits).

- Corporate bonds (better yield).

- Alternatives (higher ROI).

For them, risk isn’t a reason to avoid fixed income.

It’s a reason to plan smarter.

Transition to Comparison

This brings us to the bigger question:

If fixed income has all these risks, how does it compare to equities (stocks)?

And why do the rich hold both?

The Only Thing Riskier Than Fixed Income Is Not Knowing the Risks at All

Fixed income is safer than stocks.

But it’s not perfect.

The danger isn’t in the bonds themselves.

The danger is in ignoring the risks.

The rich know this.

They learn the rules before they play the game.

That’s why they win.

Fixed Income vs Equity Securities

To understand wealth, you must understand the difference between fixed income and equity.

The rich don’t choose one—they use both.

But they use them differently.

What Is Equity?

Equity means ownership.

When you buy a stock, you own a slice of the company.

Your profit depends on:

- Stock price going up.

- Dividends (if the company pays them).

The upside can be huge.

But the downside can be painful.

Stocks are volatile.

What Is Fixed Income?

Fixed income means lending.

When you buy a bond, you’re not an owner.

You’re a creditor.

The company owes you money.

You get paid interest no matter what, as long as they don’t default.

It’s steadier, safer, and more predictable.

Side-by-Side Example

Imagine you invest $100,000 in two ways:

- Stocks (Equity):

If the company grows, your $100,000 could become $200,000.

If it struggles, your $100,000 could drop to $50,000. - Bonds (Fixed Income):

Your $100,000 earns 5% interest.

You get $5,000 a year, and your $100,000 back at maturity.

Slow, steady, predictable.

Who Gets Paid First?

If a company goes bankrupt, bondholders are paid first.

Shareholders are last in line.

This is why wealthy investors love fixed income.

It protects their position.

Which Is Better?

- Equity = High risk, high reward.

- Fixed income = Lower risk, steady reward.

Neither is “better.”

The smart move is balance.

Wealthy families combine both:

- Fixed income for safety.

- Equity for growth.

Case Study: 10-Year Period

Investor A: $100,000 in stocks.

- After 10 years, might be $180,000… or $70,000.

Investor B: $100,000 in bonds at 5%.

- After 10 years, collects $50,000 in interest + $100,000 back.

- Total = $150,000.

Less exciting, but guaranteed.

Visual Snapshot

| Feature | Equity (Stocks) | Fixed Income (Bonds) |

|---|---|---|

| Ownership | Yes | No (you’re a lender) |

| Risk | High | Low–Medium |

| Reward Potential | Unlimited | Limited (fixed) |

| Income | Dividends (not guaranteed) | Interest (guaranteed) |

| Priority in Default | Last | First |

Why the Rich Hold Both

The rich don’t gamble everything on stocks.

And they don’t lock everything in bonds either.

They mix.

This way, they get the growth of equity and the safety of fixed income.

It’s not about being greedy.

It’s about being smart.

Transition to Modern Alternatives

But here’s the big shift in 2025.

Fixed income pays 3–5%.

Equity can swing wildly.

That’s why wealthy investors now look at modern fixed income alternatives.

The biggest? Guaranteed ROI properties that act like bonds but pay more.

The Poor Chase Excitement. The Rich Chase Certainty.

Most people chase the thrill of stocks.

The rich chase the certainty of fixed income.

One group gambles.

The other builds empires.

And that’s why the gap keeps growing.

Fixed Income Assets The richest Do not Want you to know

The Modern Alternative to Bonds

Fixed income has been the backbone of wealth for centuries.

Treasuries, corporate bonds, munis, CDs—safe, predictable, steady.

But here’s the problem today.

Yields are small.

3%… maybe 5%.

Sometimes not even enough to beat inflation.

For the ultra-wealthy, that’s not good enough.

They don’t want “just safe.”

They want safe and rewarding.

Why They Look Beyond Bonds

The rich have started asking:

“Why lock money for 10 years at 4%, when something else pays 8–10% with protection?”

That “something else” is real estate structured as fixed income.

Not normal property speculation.

Not risky flipping.

We’re talking about guaranteed ROI projects.

Properties that pay a fixed, contractual return—just like bonds.

Except the yield is far higher.

Why Dubai?

Dubai has become the global hub for these deals.

Why?

- Contracts are attested by the Dubai Land Department.

- Returns are legally protected.

- Projects offer fixed annual ROI, often for 3–12 years.

This is why billionaires are quietly moving part of their fixed income allocation into Dubai property.

It works the same way as bonds—steady checks, guaranteed terms—but pays more.

While the World Settles for 3%, Dubai Investors Quietly Lock In 10%

Here’s the shift.

Most investors settle for low-yield bonds.

But the wealthy are collecting double or triple—without extra risk.

That’s why real estate ROI is becoming the new face of fixed income.

And it’s a shift the average investor barely knows about.

Guaranteed ROI Real Estate as Fixed Income

For centuries, fixed income meant bonds, bills, and CDs.

Safe, steady—but limited.

Now, there’s a new chapter.

Real estate projects structured with guaranteed ROI contracts.

These act like fixed income but pay more—much more.

How Real Estate ROI Works Like a Bond

Think about a bond.

- You invest a set amount.

- You receive fixed payments (interest).

- At maturity, you get your money back.

Guaranteed ROI property works the same way.

- You buy into a property.

- You receive fixed returns every year (8–10%).

- At the end, you can sell or keep the asset.

The difference?

Instead of a paper certificate, your money is tied to a real, physical property.

Legal Protection in Dubai

One reason investors trust this model is the Dubai Land Department (DLD).

Contracts are registered, escrow accounts are used, and buyback clauses are built in.

This means:

- Your returns are legally secured.

- The project must follow strict regulations.

- You’re not just relying on promises—you’re backed by government oversight.

It’s fixed income, but with a property foundation.

ROI Comparison

Let’s compare traditional fixed income vs guaranteed ROI property:

| Asset Type | Typical Yield | Risk Level | Liquidity | Legal Protection |

|---|---|---|---|---|

| Treasuries | 3–5% | Very Low | High | Government-backed |

| Corporate Bonds | 4–7% | Medium | Medium | Depends on company |

| CDs | 3–4% | Very Low | Low | FDIC/NCUA insured |

| Munis | 3–5% | Low | Medium | Tax benefits |

| ROI Property (Dubai) | 8–10% | Low–Medium | Medium | Dubai Land Department verified |

This is why wealthy investors see ROI property as “fixed income 2.0.”

It pays like a bond, but with better numbers.

Examples of ROI Properties

Here are exclusive ROI opportunities:

- Maya Guaranteed ROI Property Investment

- Ready Property Investment Guaranteed ROI

- Ready Property With Guaranteed ROI in Dubai

- German Villa With Guaranteed ROI

- Real Estate Guaranteed ROI Investment Opportunity

Each of these offers structured, predictable income—just like fixed income assets the richest rely on.

Why the Rich Love It

- Higher Yield:

8–10% instead of 3–5%. - Tangible Asset:

Even if markets shift, you own property. - Diversification:

Adds real estate to portfolios without giving up fixed income security. - Luxury Factor:

Many ROI projects are tied to premium hotels, villas, and branded residences.

For the wealthy, it’s not just about income—it’s about prestige plus protection.

Case Study: $1 Million Investment

Investor A: $1M in U.S. Treasuries at 4%.

= $40,000 income per year.

Investor B: $1M in Dubai ROI property at 10%.

= $100,000 income per year.

That’s a $60,000 difference—every year.

Over 10 years, that’s $600,000 more income.

This is why the rich are making the shift.

Additional ROI Projects

More opportunities include:

- Affordable Guaranteed ROI Property for Investment

- Samana 8% Guaranteed ROI for 3 Years

- Guaranteed ROI Villa Investment for 12 Years

- Hotel Apartment Seven With 10% Guaranteed ROI

- Guaranteed ROI 10 Percent Al Haseen

Each is structured like a bond contract—but with real property behind it.

The Psychology Advantage

For investors, psychology matters.

Bonds are invisible.

They’re pieces of paper.

ROI property?

It’s something you can see, touch, and visit.

That gives confidence.

It’s why HNWIs prefer to diversify into tangible fixed-income assets.

It feels real, and it pays better.

Long-Term Security

Many ROI contracts last 3, 5, even 12 years.

During that time, you know exactly how much you’ll earn.

That stability is priceless for serious investors.

Compare that to stocks.

One year they’re up 20%.

Next year, they’re down 30%.

That’s no way to build generational wealth.

Your Money Should Work While You Sleep—Not Keep You Awake

Guaranteed ROI real estate turns your capital into a money machine.

Just like bonds, it pays on time.

But unlike bonds, it pays double.

This is why the wealthiest investors are quietly shifting their fixed income portfolios into Dubai property.

It’s the modern version of a centuries-old strategy.

bu Nahyan: Authority & Trust

Knowing about fixed income is one thing.

Finding the right guide to help you invest is another.

That’s where Abu Nahyan comes in.

Who Is Abu Nahyan?

Abu Nahyan is the founder of Atlantis Real Estate.

His company was awarded Best Luxury Independent Real Estate Brokerage in Dubai 2025.

He has also received:

- The Leadership Excellence Award from the Abu Dhabi Government.

- Recognition as an Ambassador of Society Initiative.

- Multiple international nominations for vision and leadership.

These are not just trophies.

They are proof of trust, credibility, and global respect.

Why Investors Trust Him

High-net-worth investors don’t just need properties.

They need someone who can filter out the noise and bring them only secure, high-return opportunities.

That’s exactly what Abu Nahyan does.

He specializes in guaranteed ROI properties—the modern version of fixed income.

His role is simple:

- Protect investors.

- Guide them to legally safe deals.

- Ensure predictable returns.

Exclusive Access

Not every opportunity is public.

Some projects are kept private, available only by request.

Why?

Because the best deals are often limited in number.

And the rich prefer exclusivity.

Abu Nahyan acts as the gatekeeper to these investments.

If you want access, you need the right channel.

From Fixed Income to Real Estate

Remember the story so far.

Treasuries pay 3–5%.

Corporate bonds pay 4–7%.

CDs pay 3–4%.

All safe, but small.

Now compare that to ROI properties in Dubai paying 8–10% with full legal protection.

This is why wealthy investors turn to Abu Nahyan.

He gives them access to the new wave of fixed income.

The VIP Advantage

Working with Abu Nahyan means more than numbers.

It means:

- Discretion.

- Professional handling.

- Opportunities tailored to serious investors.

That’s why global HNWIs—families, institutions, and individuals—choose him as their trusted advisor.

The Richest Already Know Who to Call. Do You?

The truth is simple.

The world’s richest already know where to go for safe, high-return fixed income alternatives.

They know Abu Nahyan.

They trust Atlantis Real Estate.

The question is—will you join them, or will you keep watching from the outside?

FAQs

Investors always have questions before moving money.

Here are the most common ones—answered clearly.

1. What are fixed income assets?

Fixed income assets are investments that pay you steady, predictable income.

Examples include government bonds, corporate bonds, municipal bonds, CDs, and mortgage-backed securities.

You lend money.

You receive interest payments.

You get your money back at maturity.

It’s the opposite of gambling.

It’s predictable wealth.

2. Why do the rich invest in fixed income?

The rich want certainty first.

They know wealth isn’t built only on big wins.

Fixed income gives them:

- A safety net of guaranteed income.

- Protection during recessions.

- Stability when markets crash.

It’s not about excitement.

It’s about control.

3. Are fixed income assets risk-free?

No.

They’re safer than stocks, but they still carry risks:

- Interest rate risk: Bond prices drop if rates rise.

- Inflation risk: Income loses value if prices climb.

- Credit risk: Companies or cities can default.

- Liquidity risk: Some bonds are hard to sell.

The rich manage these risks by diversifying and planning ahead.

4. What’s the difference between fixed income and equity?

Fixed income = lending.

Equity = ownership.

With fixed income, you get guaranteed payments.

With equity, you hope for growth (but risk big drops).

That’s why the rich combine both.

Safety from fixed income.

Growth from equity.

5. Do guaranteed ROI properties count as fixed income?

Yes.

They behave almost the same way as bonds.

- You invest.

- You receive fixed returns (8–10% annually).

- Your contract is legally secured by the Dubai Land Department.

They’re like bonds, but with a property foundation and higher yield.

6. How does inflation affect fixed income?

Inflation makes money worth less.

So a 5% bond feels small if inflation is 7%.

That’s why smart investors look for fixed income that keeps up—or beats—inflation.

ROI properties in Dubai are one example, because returns are often double inflation rates.

7. Who is Abu Nahyan?

Abu Nahyan is the founder of Atlantis Real Estate.

Awarded Best Luxury Independent Real Estate Brokerage in Dubai 2025, he is trusted by global HNWIs.

He specializes in guaranteed ROI property investments—the modern version of fixed income.

For serious investors, he is the bridge to opportunities that are not publicly available.

8. Why Dubai for fixed income real estate?

- Government protection via DLD.

- Tax-free income environment.

- High demand for luxury property.

- ROI contracts stronger than many global bond yields.

It’s safe.

It’s international.

And it pays better than most fixed income products worldwide.

9. What’s the minimum to start?

Traditional bonds can start at $1,000.

ROI property usually starts higher, often $100,000+.

That’s why it’s designed for serious investors.

It’s not for everyone—it’s for those who want stability with strong returns.

10. Should I replace all bonds with ROI property?

Not necessarily.

The rich balance.

They keep Treasuries and corporate bonds for ultra-safety.

They use ROI properties for higher yield.

The secret is diversification.

That’s what keeps wealth both safe and growing.

The Biggest Risk Is Waiting Too Long. Wealth Compounds Only If You Start Today

Every day you wait, the wealthy are collecting fixed income checks you aren’t.

They’ve already locked in safety nets.

They’ve already secured guaranteed ROI.

The question is: will you join them?