Treasury Bonds: 5 Shocking Truths You Need to Know

Table of Contents

Treasury bonds are a type of investment. They are safe and offer regular payments. In this guide, we will explain everything about Treasury bonds. You will understand Treasury bonds very easily. It does not get any simpler than this over here. We will also mention some shocking truths about these bonds. Get ready!

What Are They?

Definition

Treasury bonds are long-term loans to the government. They are also known as T-bonds. When you buy one, you are lending money to the government. In return, the government pays you interest. This interest is paid every six months.

How They Work

Here’s how Treasury bonds work. You buy a bond at a certain price. The bond has a fixed term, like 10, 20, or 30 years. Every six months, the government pays you interest. At the end of the term, you get your money back.

Types

- Standard Bonds: These are the most common. They last for 10, 20, or 30 years. You get regular interest payments.

- Inflation-Protected Bonds: These bonds adjust for inflation. This helps protect your investment from rising prices.

Why Invest in them?

Safety

They are very safe. The government backs them. This makes them a low-risk investment.

Steady Income

You get regular interest payments. This provides a steady income stream. It is helpful for planning your finances.

Predictable Returns

You know exactly how much you will get back. This helps with planning and budgeting. There are no surprises.

Why Investors Choose Treasury Bonds

Low Risk

They have very low risk. The U.S. government guarantees them. This means you are very likely to get your money back.

Stable Payments

You get steady interest payments. This makes it easier to plan your finances. You know how much money you will receive.

Easy to Buy

It is easy to buy them. You can buy them through banks or online brokers. The process is simple and straightforward.

Safe Investment

Treasury bonds are a safe place to put your money. They are less risky than stocks or real estate.

Diversification

Moreover, when you top off your investment portfolio with these bonds, you will have a diversified and strong portfolio. Therefore, reducing the risks of not losing all your investment

How to Buy Treasury Bonds in the UAE

Steps to Buy

- Open an Account: You need a brokerage account. Many banks and financial institutions offer this service.

- Choose a Bond: Decide which bond fits your needs. Consider the term and interest rate.

- Place Your Order: You can buy these bonds through your broker. They will handle the purchase for you.

Where to Buy

- Banks: Many banks sell T. Bonds. You can visit a bank branch or their website.

- Online Brokers: There are online platforms where you can buy bonds. They offer a simple way to purchase bonds.

Current Rates

Interest rates for T. Bonds can change. They are based on the economy. Check current rates from reliable sources.

How Much Do 1-Year Treasury Bonds Pay?

Current Rates

As of 2024, 1-year T. Bonds pay around 1.5% to 2% interest. This rate can change based on market conditions.

Historical Rates

1-year T. Bonds usually pay lower interest rates than longer-term bonds. This is because they are less risky.

Comparison with Other Investments

1-year T. Bonds generally pay less than stocks or real estate. If you want higher returns, other investments might be better.

What Are Treasury Bonds Right Now?

Current Market Conditions

Your bonds are influenced by the economy. Recent events, like inflation and interest rate changes, affect their value.

Recent Data

- Interest Rates: Check the latest rates from reliable sources.

- Bond Prices: Prices can vary based on demand and economic conditions.

How to Stay Updated

To stay updated on Treasury bonds, check financial news and market reports. This will help you understand current rates and market conditions.

The 5 Shocking Truths About Treasury Bonds You Need to Know

1. Lower Yields Than Expected

Many people are shocked by how little these bonds pay. Even though they are safe, the returns might be low. For example, 1-year Treasury bonds pay only 1.5% to 2%. This is less than some other investments.

2. Inflation Can Reduce Gains

They simply can lose value because of inflation. Inflation means prices go up. This can make your interest payments worth less over time.

3. Long-Term Commitment

When you buy Treasury bonds, you might need to keep your money tied up for a long time. For example, 10-year or 30-year bonds keep your money for many years. If you need your money sooner, you might lose money.

4. Limited Growth Potential

These bonds do not grow as much as stocks or real estate. They are safe but do not offer high returns. This might not be good if you want your money to grow quickly.

5. Changing Market Conditions

The value of these bonds can go up and down. If interest rates go up, the value of your bonds might go down. You could lose money if you sell your bonds before they are due.

Comparing Treasury Bonds to Other Investments

Stocks

- Potential Returns: Stocks can offer higher returns than T. bonds.

- Risk: Stocks are more risky than Treasury bonds. They can go up and down in value.

Real Estate

- Potential Returns: Real estate can offer good returns and growth.

- Risk: Real estate can be risky. It requires more management than Treasury bonds.

Mutual Funds

- Potential Returns: Mutual funds offer a mix of investments. They can provide good returns.

- Risk: Mutual funds are less risky than stocks but riskier than Treasury bonds.

Tips for Investing in Treasury Bonds

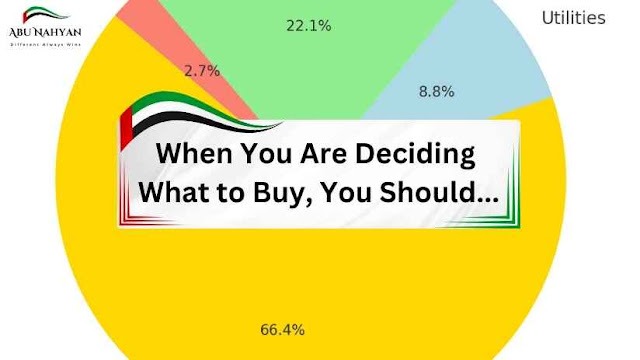

1. Know Your Goals

Before investing, know what you want to achieve. Are you looking for safety or high returns?

2. Understand the Terms

Keep in mind that they come with different terms. Choose one that fits your investment horizon.

3. Diversify Your Portfolio

Do not put all your money in these bonds. Invest in other assets to balance risk.

4. Stay Informed

Keep up with market conditions and interest rates. This helps you make better investment decisions.

5. Consider Inflation

Be aware that inflation can affect your returns. Choose bonds that offer protection against inflation if possible.

How Treasury Bonds Fit Into Your Investment Strategy

Long-Term Investment

T. Bonds are a good option for long-term investment. They provide steady income over many years. They are especially useful if you plan to invest for retirement.

Short-Term Needs

If you need cash soon, These bonds might not be the best choice. They have long terms. Consider other investments if you need quick access to your money.

Balancing Your Portfolio

Treasury bonds help balance your investment portfolio. They are safe and provide regular income. They reduce the overall risk of your investment mix.

Tax Benefits

In some cases, interest from Treasury bonds is tax-exempt. This means you do not have to pay taxes on the interest. Check local tax rules to see if this applies to you.

Common Myths About Treasury Bonds

Myth 1: Treasury Bonds Are Risk-Free

While Treasury bonds are very safe, they are not completely risk-free. Inflation can reduce their value. Also, if interest rates rise, the value of existing bonds can drop.

Myth 2: You Will Always Get High Returns

These bonds do not always offer high returns. Their returns are often lower than stocks or real estate. They are safe, but not the best for high growth.

Myth 3: Treasury Bonds Are Only for Rich People

Anyone can invest in them. You do not need to be rich. They are accessible to many types of investors.

Myth 4: You Cannot Lose Money

You can lose money if you sell your bonds before they mature. Their value can drop if interest rates go up. Holding them to maturity helps avoid this risk.

Recent Changes in the Treasury Bond Market

Impact of Inflation

Inflation affects your bonds. When inflation is high, the real value of the interest payments decreases. This can make bonds less attractive.

Interest Rate Changes

Interest rates influence these bonds. When rates go up, new bonds offer higher interest. Existing bonds might decrease in value.

Economic Conditions

Economic conditions affect bond prices. In uncertain times, Treasury bonds can be more attractive. They are seen as a safe investment.

Government Policies

Government policies can impact Treasury bonds. Changes in fiscal policy or debt levels can influence interest rates and bond prices.

Case Studies and Examples

Case Study 1: Long-Term Investment Success

John invested in 30-year T. Bonds. He received steady interest payments. After 30 years, he got back his initial investment. Despite low returns, the steady income was valuable.

Case Study 2: Inflation Impact

Sara bought 10-year Treasury bonds when inflation was low. Inflation increased, reducing the real value of her interest payments. She noticed a decrease in purchasing power.

Case Study 3: Interest Rate Changes

Mark invested in 5-year T. Bonds. Interest rates rose after he bought them. The value of his bonds decreased, but he held them until maturity and received his principal and interest.

Conclusion

We could simply say that T. Bonds is a safe investment. They provide regular income and are backed by the government. However, they might not offer high returns compared to other investments. They are best for those seeking stability and low risk.

Remember, Treasury bonds are just one part of investing. Diversify your investments to achieve the best results. Keep learning and stay updated on market conditions to make informed decisions.

1- Investment Bonds: Critical Mistakes

2- Dubai City of Gold: 7 Amazing Facts About Investing in Gold in Dubai

3- Treasury Bonds Official Website