Investment Appraisal: 3 Amazing Simple Examples

Table of Contents

Investment appraisal helps you know if an investment is smart. It means checking if putting money into something will make you more money. Businesses use it to decide where to spend money. You can use it too. It helps you see if you will gain or lose money.

What is Investment Appraisal?

Investment appraisal is like a test. It helps you figure out if spending money on something is a good idea. It shows if you will get more money back than you spend. Businesses do this to make smart decisions. They want to know where their money will grow.

Simple Methods for Investment Appraisal

1. Payback Period

This is very simple. It shows how long it will take to get your money back. For example, if you invest $1000 and get $500 back each year, it takes 2 years to get your money back. It is easy, but it does not show what happens after you get your money back.

Example 1:

You open a small coffee shop. You spend $20,000 to start it. The shop makes $5,000 in profit each year. Using the payback period, it will take 4 years to get back your $20,000.

2. Net Present Value (NPV)

NPV helps you see how much money you will make in the future. It also checks how money loses value over time. If you make more than you spend, NPV is good. If not, NPV is bad. It is good for long-term investments.

Example 2:

You invest $10,000 in a real estate project. Over 5 years, you expect to make $2,000 per year. NPV will help you check if the total future value of these payments is more than your $10,000 today, considering the value of money over time.

3. Internal Rate of Return (IRR)

IRR shows how fast your money will grow. It gives a percentage, like 10% each year. If the IRR is high, it’s a good investment. But it can be hard to calculate.

Example 3:

You invest $5,000 in a stock. After 5 years, you sell it for $7,500. The IRR method can tell you what the yearly return percentage is, based on how your money grew from $5,000 to $7,500.

4. Discounted Cash Flow (DCF)

DCF shows how much money your investment will make in the future. It also checks how much value the money will lose over time. This is very helpful but can be hard to predict. You need good estimates for it to work.

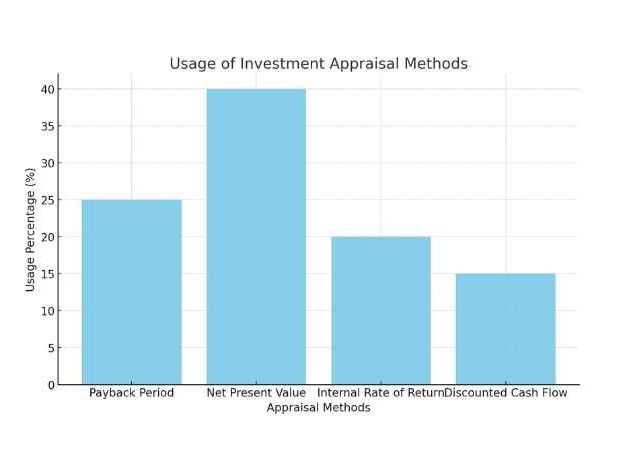

Graph 1: Usage of Investment Appraisal Methods

This graph shows how often different methods are used.

In the graph, you can see that Net Present Value (NPV) is used the most. People like it because it is detailed. Payback Period is also used a lot because it’s simple.

What is the Best Way to Appraise Investments?

There is no one best way. The best method depends on the project. Payback Period is good for short projects. NPV and IRR are good for long-term investments.

What is “Investment Value”?

Investment value is the worth of an investment to you. It can be different from market value. Market value is what others think it’s worth. Investment value is what you think it’s worth for your goals.

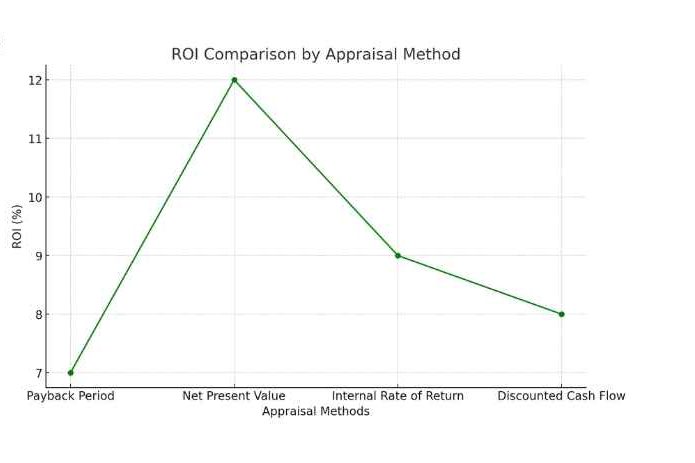

Graph 2: ROI Comparison by Appraisal Method

This graph shows how different methods compare for Return on Investment (ROI).

You can see that NPV gives a higher return than Payback Period. This is why more people use NPV when thinking about long-term investments.

What is Strategic Investment Appraisal?

Strategic investment appraisal looks at more than just money. It helps you see how the investment fits with your bigger plan. Does it help your business grow? Does it help you reach your goals? This type of appraisal looks at both money and strategy.

What is the Scope of Investment Appraisal?

Scope means how much you check. Some appraisals only check how much money you will make. Others also check if the investment fits with your business plan. The scope can be small or big, depending on what you need.

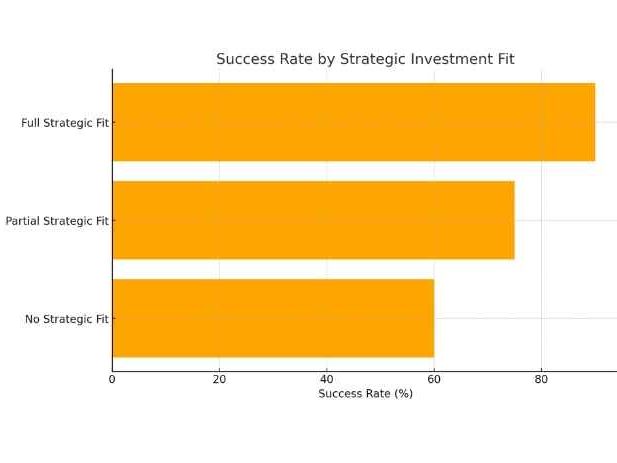

Graph 3: Success Rate by Strategic Investment Fit

Here’s a graph that shows how well investments do when they fit with the strategy.

As you can see, the success rate is higher when the investment fits the strategy. Businesses that think about strategy have a 90% success rate. This shows how important it is to look at the big picture.

Sensitivity Analysis: Checking Different Outcomes

Sensitivity analysis checks what happens if things change. For example, what if your sales are lower than expected? It helps you see if the investment is still good when things don’t go as planned. It changes one thing at a time to show the result.

Monte Carlo Simulation: Looking at Many Results

Monte Carlo simulation checks many possible outcomes. It uses random samples to show different results. This is good for risky investments. It helps you see both the best and worst outcomes.

Real Options: Flexibility in Investment

Real options give you choices. You can wait before making a decision. This gives you flexibility. You can change your mind if things don’t go as planned. This is good for investments with lots of uncertainty.

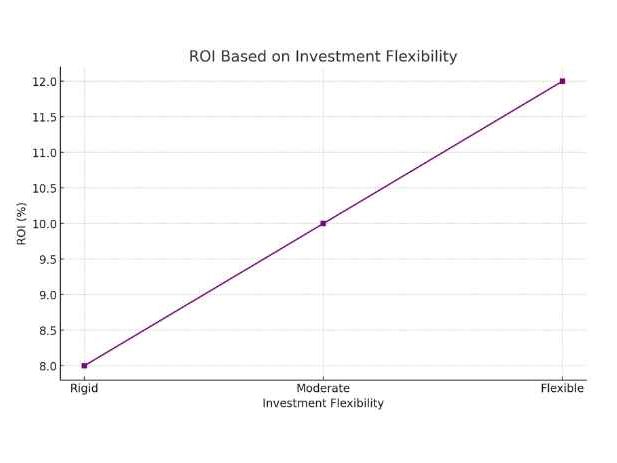

Graph 4: ROI Based on Investment Flexibility

This graph shows how being flexible with your investment can affect your Return on Investment (ROI).

You can see that more flexible investments give higher returns. This is because you can make changes if things go wrong.

Risk and Profitability: Be Careful

You should always think about risk. Some investments have low risk but low profit. Some have high risk and high profit. You need to balance the risk with what you can afford to lose.

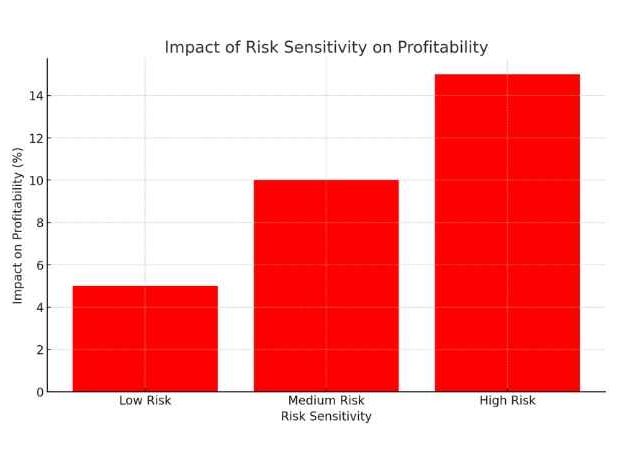

Graph 5: Impact of Risk Sensitivity on Profitability

This graph shows how risk affects profitability.

The higher the risk, the more money you might make. But remember, high risk also means you could lose money. Always think about the risk before investing.

Simple Tips for Smart Investment Appraisal

- Check Your Cash Flow: Make sure the investment brings in more money than it costs.

- Think Long-Term: Don’t just look at quick profits. Think about how the investment will help you in the future. See some consequences of NOT saving money early

- Use the Right Method: Pick the best appraisal method for your investment. Use NPV for long-term projects and Payback Period for short-term.

Why Data is Important in Investment Appraisal

Using data helps you make better choices. You can use data from past projects to guess how new projects will do. For example, if a similar project made money, this one might too.

According to a Deloitte report, businesses that use better investment appraisal methods make 12% more profit. Also, companies that look at both money and strategy are 18% more likely to reach their goals.

Read more: Investment Appraisal: 3 Amazing Simple Examples

1-Investment Property: Mistakes to Avoid

2- Investment Demand Curve 101: All you Need to Know

3- More Info on Investment Appraisal