Investment Property : Mistakes you must Avoid!

Table of Contents

What is Investment Property?

An investment property is a way to make money. It can be a house or land. You buy it to rent or sell later. Many people invest in property. It helps build wealth. But it’s not always easy. You must know what you are doing. This guide explains it simply. It also talks about Dubai. Dubai is a great place to invest.

Also, an investment property is a land or a building. You buy it to make money. You can make money in two ways:

- Rent: You rent it out. Someone pays you every month.

- Sell: You sell it later for more than you paid.

Many types of property are good for investing. You can buy homes, apartments, or land. Some people buy to rent out. Others wait for the price to go up and sell.

Types of Investment Property

There are many types. Let’s look at them.

1. Residential Property

This is the most common. It includes homes and apartments. You rent it to families or people.

- Good Side: People always need homes. High demand.

- Bad Side: Repairs and costs. You need to fix things often.

2. Commercial Property

These are buildings for businesses. Examples are stores or offices.

- Good Side: Businesses pay more rent. They also stay longer.

- Bad Side: More expensive. It can take time to find new tenants.

3. Mixed-Use Property

It has homes and businesses in one place. For example, a shop on the first floor and homes above.

- Good Side: You earn money from both.

- Bad Side: Hard to manage both.

4. Vacation Rentals

These are homes rented for short stays. Many people use sites like Airbnb for this.

- Good Side: You can charge more during tourist seasons.

- Bad Side: Hard to rent all year long.

What Makes a Good Investment Property?

Not all properties are good investments. Here’s what to look for:

1. Location

Location is key. Properties in popular areas are worth more. Look for places with schools and shops nearby. People like living in those areas.

2. Market Trends

Look at the market. Are prices going up or down? Buy where prices are rising. You will make more money.

3. Costs

You need money to buy and keep the property. There are taxes and repairs. Some places need a lot of work. Others are ready to rent. Know all the costs first.

4. Rental Demand

Check if people want to rent there. If many people want to rent, it’s easy to find tenants. If not, it’s harder to rent out.

5. Size

Bigger is not always better. A small apartment in a good area is better than a big house in a bad area.

Why Invest in Dubai?

Dubai is a top place to invest. The city grows fast. Here’s why you should invest there:

1. No Property Tax

There is no property tax in Dubai. You don’t pay the government for owning a property.

2. Growing Economy

Dubai is growing. More people move there every year. This means more demand for homes and offices.

3. Tourism

Many tourists visit Dubai. Vacation rentals near tourist spots make a lot of money.

4. Safe Market

Dubai has strong laws to protect buyers. It is a safe place to invest.

How to Invest in Dubai

Follow these steps to invest in Dubai:

1. Pick the Right Area

Different parts of Dubai have different prices. Some are more expensive but give better returns. The top areas include Downtown Dubai and Dubai Marina.

2. Choose the Right Type of Property

As we talked about earlier, there are many types. Pick what fits your budget and goals.

3. Understand Financing

You may need a loan to buy a property. Foreigners can get loans in Dubai, but the rules are different.

4. Legal Procedure

Follow the law when buying. Register the property with the Dubai Land Department. Have all the papers ready.

5. Pick the Right Company

It is necessary to work with a reputable company to take care of all your investment needs and sustain them.

Mistakes to Avoid

Investing can be great. But many people make mistakes. Here’s how to avoid them:

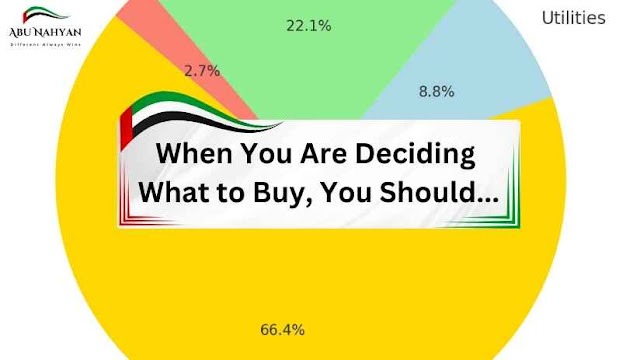

1. Not Doing Research

Some people buy without checking the market. They may buy it just because it’s cheap. Always check the location and market. Know what you are buying.

2. Ignoring Costs

It’s easy to forget about all the costs. There are taxes, repairs, and fees. Have a budget for everything. Know how much it will cost to fix things.

3. Wrong Location

Location is everything. Some people buy in bad areas because it’s cheap. But it will be hard to rent or sell later. Always pick a location where people want to live or invest.

4. Overpaying

Some people love a property too much. They pay too much for it. This is a mistake. Check the prices of other properties first. Don’t let emotions decide.

5. Ignoring Maintenance

Some properties look cheap but need repairs. Big repairs like roofs or pipes cost a lot. Check the property carefully before buying.

6. No Exit Plan

What if things go wrong? Some people don’t plan for that. Know when you will sell. Have a plan for bad situations. Get help here

Good and Bad of Property Investment

Let’s look at the good and bad sides.

Good Side

- Earn Rent: You make money every month.

- Price Goes Up: The property can become more valuable over time.

- Lower Taxes: You can get tax benefits.

Bad Side

- Costs: Buying and fixing up property costs money.

- Risk: Property values can go down.

- Hard Work: Managing the property takes time and effort.

Investment Property vs. Your Home

Investment property is not the same as your home. Here’s the difference:

- Taxes: You get more tax breaks with investment property.

- Loans: Investment property needs bigger down payments.

- Management: You have to manage tenants and repairs with investment property.

How to Make More Money with Investment Property

1. Keep It Nice

Good properties get rented faster. Keep it clean and well-maintained. Tenants will pay more for a nice place.

2. Know Rent Prices

Check what others charge. Set your rent at the right price. Not too high, not too low.

3. Make Small Fixes

Small upgrades can make a big difference. New appliances or a fresh coat of paint can increase value.

4. Watch the Market

The market changes. Keep an eye on trends. Know when to buy or sell.

Conclusion

Property investment can help you build wealth. But you need to be smart. Pick the right place, know the costs, and understand the risks. Dubai is a great place to invest. The market is growing, and there are many chances to make money. Follow this guide to make the best investment choices.

Read more: Investment Property : Mistakes you must Avoid!

- Property News NI that will Blow your Mind

- Budgeting Loans 101: Avoid Debt Mistakes

- Top Real Estate Investment in Dubai